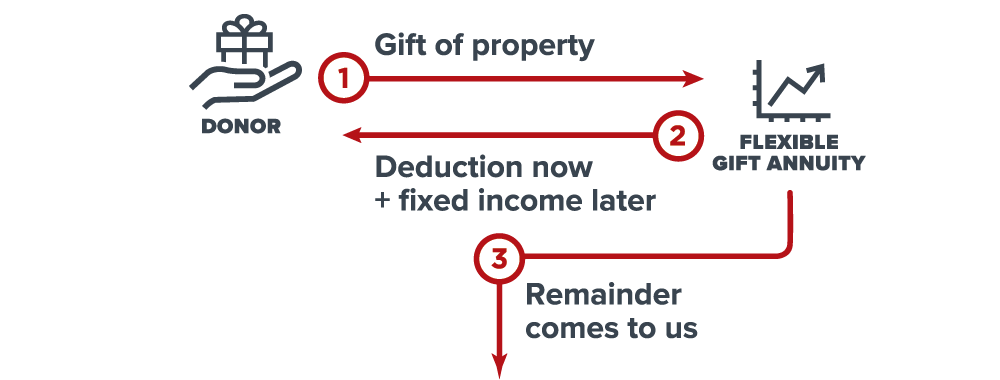

Flexible Gift Annuity

How It Works

- You transfer cash or securities to DonorsTrust. Our suggested minimum gift requirement is $10,000.

- You select a range of dates in the future (window) when you will want DonorsTrust to begin paying you, or up to two annuitants you name, fixed annuity payments for life.

- During the payment window, you request the start of payments.

- Beneficiaries are recommended to be at least 40 to begin receiving payments and must be at least 65 to fund the gift.

- The remaining balance passes to DonorsTrust when the contract ends.

Benefits

- Deferral of payments permits a higher annuity rate and generates a larger charitable deduction. The deduction is calculated based upon the first date in your window on which you could elect to start payments.

- You can target your annuity payments to begin when you need them, such as retirement.

- The longer you elect to defer payments, the higher your payment will be.

Next

- More details on Flexible Gift Annuities.

- Frequently asked questions on Flexible Gift Annuities

- Contact us so we can assist you through every step.